Property By Helander Llc - The Facts

Property By Helander Llc - The Facts

Blog Article

4 Simple Techniques For Property By Helander Llc

Table of ContentsSome Known Factual Statements About Property By Helander Llc Unknown Facts About Property By Helander LlcThe 5-Minute Rule for Property By Helander LlcProperty By Helander Llc for DummiesExamine This Report on Property By Helander LlcWhat Does Property By Helander Llc Mean?

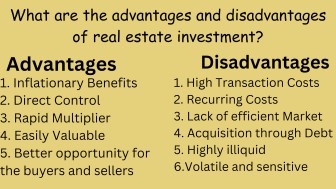

The advantages of spending in real estate are countless. Below's what you need to know regarding actual estate benefits and why real estate is taken into consideration an excellent financial investment.The advantages of spending in real estate include passive revenue, steady cash money flow, tax obligation advantages, diversity, and take advantage of. Genuine estate investment counts on (REITs) supply a means to spend in real estate without having to own, run, or money residential or commercial properties.

In most cases, capital just reinforces gradually as you pay for your mortgageand construct up your equity. Genuine estate financiers can make the most of various tax breaks and reductions that can conserve money at tax obligation time. Generally, you can subtract the reasonable costs of owning, operating, and managing a home.

Property By Helander Llc Can Be Fun For Anyone

Realty values have a tendency to increase in time, and with an excellent financial investment, you can turn an earnings when it's time to offer. Leas likewise have a tendency to rise over time, which can result in higher capital. This graph from the Reserve bank of St. Louis shows mean home costs in the united state

The areas shaded in grey indicate united state economic downturns. Median List Prices of Houses Cost the USA. As you pay for a residential property home loan, you build equityan possession that's component of your internet well worth. And as you build equity, you have the take advantage of to purchase even more homes and increase capital and wide range much more.

Since genuine estate is a concrete property and one that can serve as collateral, financing is readily offered. Actual estate returns differ, depending on elements such as location, asset class, and monitoring.

How Property By Helander Llc can Save You Time, Stress, and Money.

This, consequently, converts right into higher resources worths. As a result, realty tends to preserve the purchasing power of resources by passing a few of the inflationary pressure on tenants and by integrating some of the inflationary pressure in the kind of resources appreciation. Home mortgage borrowing discrimination is prohibited. If you believe you have actually been discriminated versus based on race, religion, sex, marital standing, use public support, national origin, handicap, or age, there are actions you can take.

Indirect genuine estate spending involves no straight ownership of a residential or commercial property or residential or commercial properties. There are numerous ways that having real estate can safeguard against inflation.

Residential properties financed with a fixed-rate finance will click reference see the relative amount of the monthly home loan repayments drop over time-- for instance $1,000 a month as a set payment will become less challenging as rising cost of living deteriorates the purchasing power of that $1,000. (https://www.40billion.com/profile/868714106). Usually, a primary home is not thought about to be a realty investment considering that it is utilized as one's home

The Main Principles Of Property By Helander Llc

Even with the assistance of a broker, it can take a few weeks of job simply to find the appropriate counterparty. Still, realty is an unique asset course that's straightforward to understand and can boost the risk-and-return account of a capitalist's portfolio. By itself, property provides cash money circulation, tax breaks, equity building, affordable risk-adjusted returns, and a hedge versus rising cost of living.

Purchasing realty can be an extremely fulfilling and financially rewarding endeavor, yet if you resemble a great deal of new investors, you might be questioning WHY you must be spending in real estate and what advantages it brings over various other financial investment chances. In enhancement to all the remarkable advantages that come along with spending in real estate, there are some downsides you need to take into consideration.

Examine This Report about Property By Helander Llc

If you're searching for a way to purchase right into the property market without needing to invest numerous countless dollars, have a look at our residential properties. At BuyProperly, we use a fractional possession model that enables investors to start with as little as $2500. One more major benefit of actual estate investing is the ability to make a high return from purchasing, refurbishing, and re-selling (a.k.a.

Get This Report on Property By Helander Llc

As an example, if you are charging $2,000 rent monthly and you sustained $1,500 in tax-deductible expenditures each month, you will only be paying tax obligation on that $500 earnings each month. That's a large difference from paying tax obligations on $2,000 per month. The profit that you make on your rental for the year is taken into consideration rental earnings and will certainly be taxed as necessary

Report this page